Your Guide to Outcome-Based Pricing with Practical Examples

Discover the power of outcome-based pricing in SaaS: How aligning costs with customer success can drive growth, value, and trust in today’s competitive landscape

Nov 19, 2024

In today’s SaaS landscape, traditional subscription models are no longer the default approach to pricing. As discussed in our article on usage-based pricing, more companies are adopting models that align cost with usage delivered. One particularly effective subset of usage-based pricing is outcome-based pricing (also called sucess-based pricing or result-based pricing), which measures specific metrics directly linked to the product's core value. For example, payment processors like Stripe charge a commission on the total money processed, tying their revenue to the primary outcome they enable for customers that is secure transactions.

Outcome-based pricing works by charging customers based on their success with the product. This model directly aligns the SaaS provider’s revenue with the customer’s achieved outcome, making it an attractive option for businesses aiming to create value-driven relationships. In this article, we’ll explore this model’s practical applications, discuss its advantages and potential drawbacks, and look at how companies effectively use outcome-based pricing in different sectors.

Examples of Outcome-Based Pricing

Here are several use cases from various sectors where outcome-based pricing shines:

Payment Service Providers (PSPs)

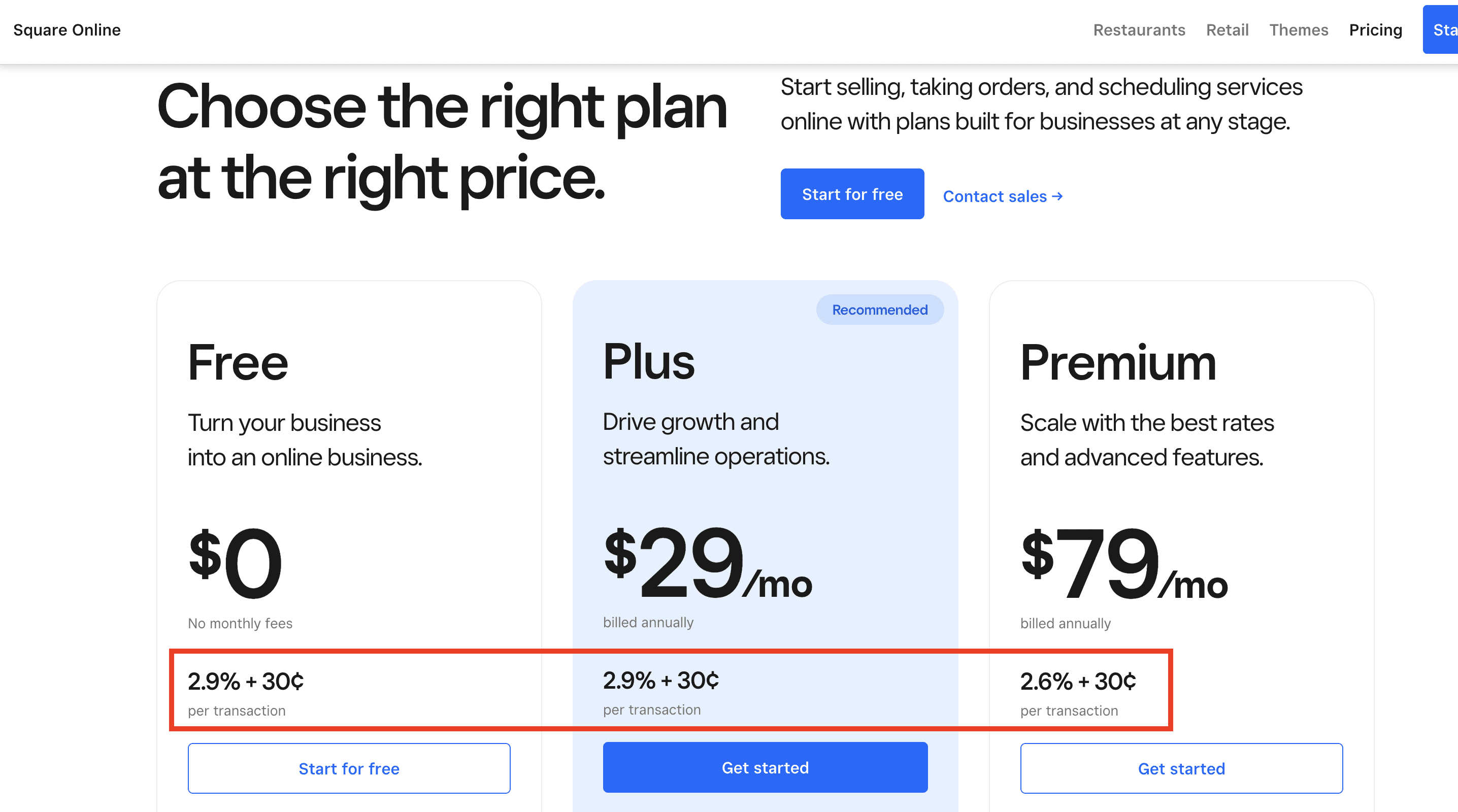

Payment service providers like Stripe, Square, Lemonsqueezy, and PayPal have led the way in outcome-based pricing. Their approach typically involves charging a percentage of the processed amount, linking their success directly to the customer’s revenue flow. Each time a merchant processes a transaction, they pay a small commission, which makes it an affordable entry point while ensuring that fees scale with growth.

Square prices based on a percentage per transaction

Customer Support Software

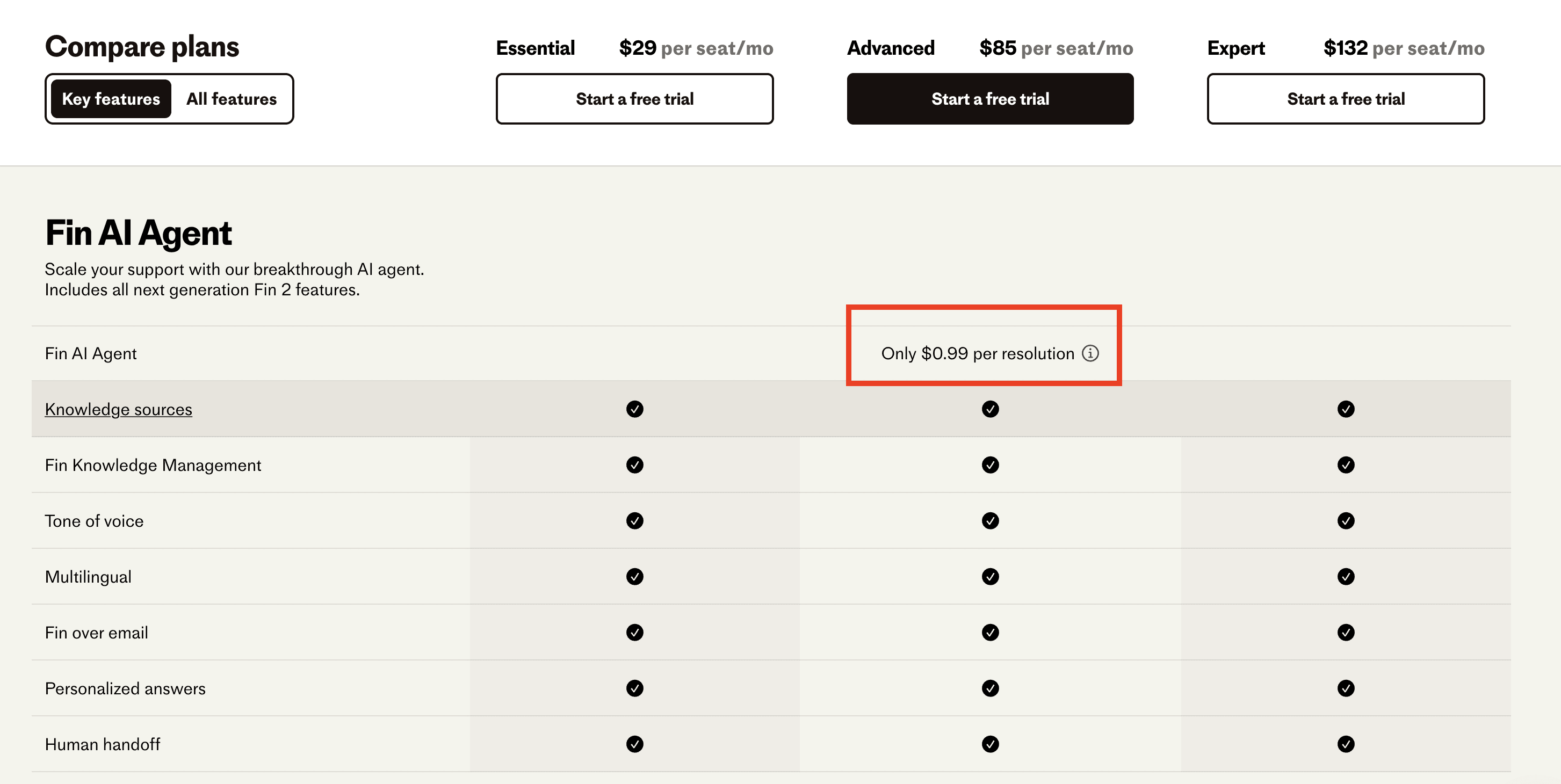

Another prominent example comes from the customer support industry. Companies such as Intercom Fin AI Copilot and Zendesk AI implement outcome-based pricing by charging according to the number of support tickets their AI resolves. This allows companies to pay based on actual support volume, lowering the barrier to adoption while scaling as their needs grow. In this way, businesses can directly relate support costs to service effectiveness.

Intercom Fin AI prices based on the number of resolved tickets

Marketing platforms:

Take Livestorm and Contrast as examples. Both are webinar tools designed to help companies generate qualified leads, which is their core value proposition. Their pricing models can be considered outcome-based, as they hinge on the number of active contacts or registrants, a metric closely tied to the number of qualified leads sent to the CRM. Essentially, the pricing scales directly with the value they provide.

Contrast bills every unique registrant to a webinar, which can become leads in the CRM

Referral And Affiliate Program Tools:

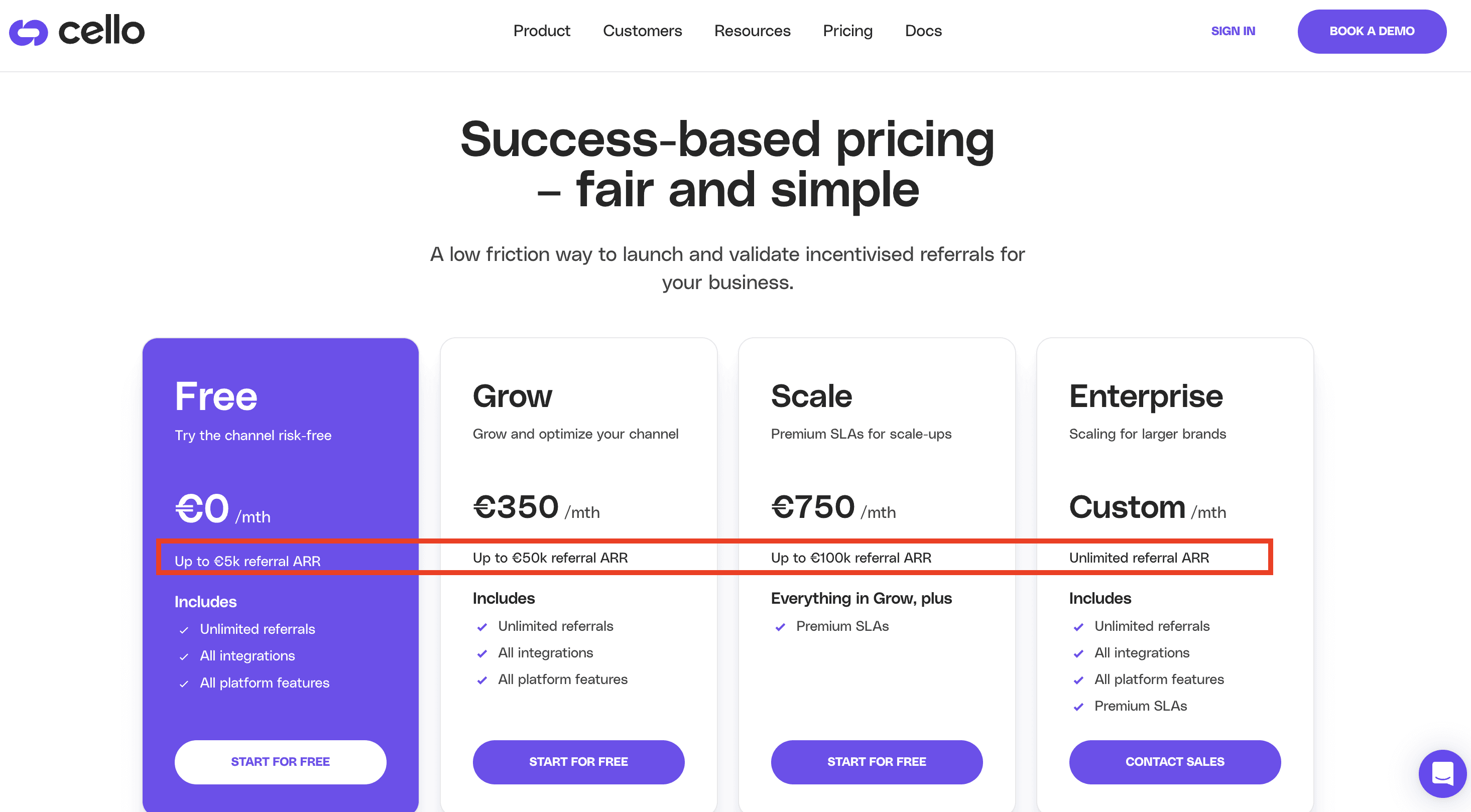

Tools like Cello and Rewardful help companies manage referral programs, and both offer outcome-based pricing by charging based on the Annual Recurring Revenue (ARR) generated from those referrals. This structure benefits clients by eliminating upfront fees; they only pay when referral programs contribute to their ARR, reducing risk and aligning Cello’s and Rewardful’s fees with clients’ performance.

These examples demonstrate outcome-based pricing in action across different sectors, helping companies balance accessibility and scalability while linking fees to their customers’ business outcomes.

Cello’s tiers are defined based on the referral ARR that their customers make

Pros and Cons of Outcome-Based Pricing

Outcome-based pricing offers distinct advantages in aligning cost with value, but it also comes with potential challenges. Here’s a closer look at the pros and cons.

Pros

Win-Win Scenario for Both Parties:

Outcome-based pricing models establish a win-win scenario, making it easy for customers to see value in the product. The fundamental advantage is that customers only pay when they derive value from the solution. This alignment of interests between the provider and the customer builds trust and makes the relationship feel like a partnership. If the product delivers real results, the SaaS provider earns revenue. If not, the customer incurs minimal cost.Low Entry Barrier for Customers:

Outcome-based pricing allows businesses to lower the initial price barrier, which simplifies converting leads into customers. Since these models often start with low initial costs that evolves with usage, prospects feel less risk and are more inclined to give the service a try. For example, Cello allows users to launch a referral program and start paying only once they generate tangible ARR. This gradual approach helps ease customers into using the product and increases adoption rates without the fear of upfront costs.Empowers Product Teams:

Aligning product work with clear financial outcomes is often challenging. When your team releases a new feature, it’s hard to gauge how much it genuinely drives business growth for the customer.With outcome-based pricing, however, any feature that boosts the product's value metric directly impacts revenue. This clarity makes it easier to align product teams with business and go-to-market goals—an especially valuable advantage in organizations with multiple product teams.

Cons

Exposure to Competitive Pricing Pressures:

While outcome-based pricing aligns cost with value, it can expose companies to intense competitive pressure. Because this model makes it easier for competitors to measure costs and margins, new entrants might emerge with lower pricing, sparking a pricing battle. As competitors adopt similar outcome-based metrics, businesses may feel pressure to lower fees or add more value to remain competitive, potentially leading to reduced margins.Wide Distribution of Customer MRR Makes Projections Difficult:

One of the unique challenges with outcome-based pricing is the potential for a wide variance in Monthly Recurring Revenue (MRR) among customers, leading to an inconsistent spread of MRR across the client base. This wide standard deviation complicates revenue forecasting and makes key metrics like MRR or Average Revenue per Account (ARPA) less reliable. When revenue fluctuates significantly based on individual client outcomes, companies may struggle with revenue consistency, making it difficult to benchmark success or use traditional SaaS valuation models that rely on predictable MRR growth. This issue is particularly impactful for planning financials, making it more complex to anticipate revenue stability or align with conventional valuation metrics.Potential Perception of High Costs for Successful Customers:

For companies with high levels of success, outcome-based models can quickly drive up costs, leading to the perception that they are “too expensive.” Unlike traditional models, outcome-based pricing doesn’t allow for economies of scale—costs rise in direct proportion to success, rather than leveling off with increased usage. As a customer’s outcomes grow, so do their fees, which can sometimes surpass the costs of alternative solutions that use flat or usage-capped pricing. For example, a company with a high volume of successful transactions or referrals may find that outcome-based fees become more expensive than a fixed-price or capped model.

Is Outcome-Based Pricing Right for Your SaaS Business?

Outcome-based pricing is a strategic choice that can significantly impact customer satisfaction and revenue. By linking fees to customer success, it strengthens alignment and encourages a performance-oriented approach. However, it requires a clear understanding of the customer’s primary success metrics and a willingness to accept that revenue may vary depending on customer results.

Consider outcome-based pricing if:

Your product delivers a specific, measurable outcome that reflects its value.

Your customers are growth-focused and benefit from the flexibility of scaling costs with their usage.

You operate in a competitive market where proving value upfront could be a conversion advantage.

You are a new business: starting with an “outcome-based” pricing model requires no upfront costs, allows you to track the actual impact of your product, and validates market willingness to pay.

On the other hand, this model may not be suitable if:

You have a niche product with a hard-to-define outcome metric.

The industry is already highly competitive, and you could risk margin erosion.

Your customer base is wary of variable pricing and prefers predictable costs.

Conclusion

As more companies shift towards value-driven pricing, outcome-based models are likely to grow in popularity within SaaS. By aligning pricing with customer success, these models not only enhance conversion rates but also reinforce a commitment to real value.

Currently, few billing platforms offer native support for outcome-based pricing, but we can expect next-generation billing software to incorporate these features as a standard in the future.